All Categories

Featured

Comparable to various other life insurance coverage policies, if your clients smoke, make use of other kinds of cigarette or nicotine, have pre-existing health and wellness conditions, or are male, they'll likely have to pay a greater price for a final cost plan (final expense insurance scams). The older your client is, the higher their price for a strategy will be, since insurance firms believe they're taking on even more threat when they provide to guarantee older clients.

The policy will certainly likewise remain in pressure as long as the policyholder pays their premium(s). While numerous other life insurance coverage plans might require clinical exams, parameds, and attending doctor statements (APSs), last expenditure insurance policy plans do not.

Final Expenses Benefit

Simply put, there's little to no underwriting called for! That being said, there are 2 main kinds of underwriting for final cost plans: simplified problem and guaranteed issue. selling funeral policies. With streamlined problem plans, clients normally just have to address a few medical-related questions and might be refuted coverage by the carrier based on those responses

For one, this can allow agents to figure out what kind of plan underwriting would function best for a particular client. And two, it helps agents tighten down their client's alternatives. Some service providers may invalidate clients for protection based on what drugs they're taking and how lengthy or why they have actually been taking them (i.e., maintenance or therapy).

Insurance To Cover Funeral Costs

A final expense life insurance policy is a type of long-term life insurance plan. what does burial insurance cover. While this policy is developed to assist your beneficiary pay for end-of-life costs, they are cost-free to utilize the fatality advantage for anything they require.

Just like any kind of other long-term life policy, you'll pay a normal costs for a last expenditure plan for an agreed-upon survivor benefit at the end of your life. Each provider has various rules and options, yet it's reasonably easy to manage as your beneficiaries will have a clear understanding of exactly how to spend the money.

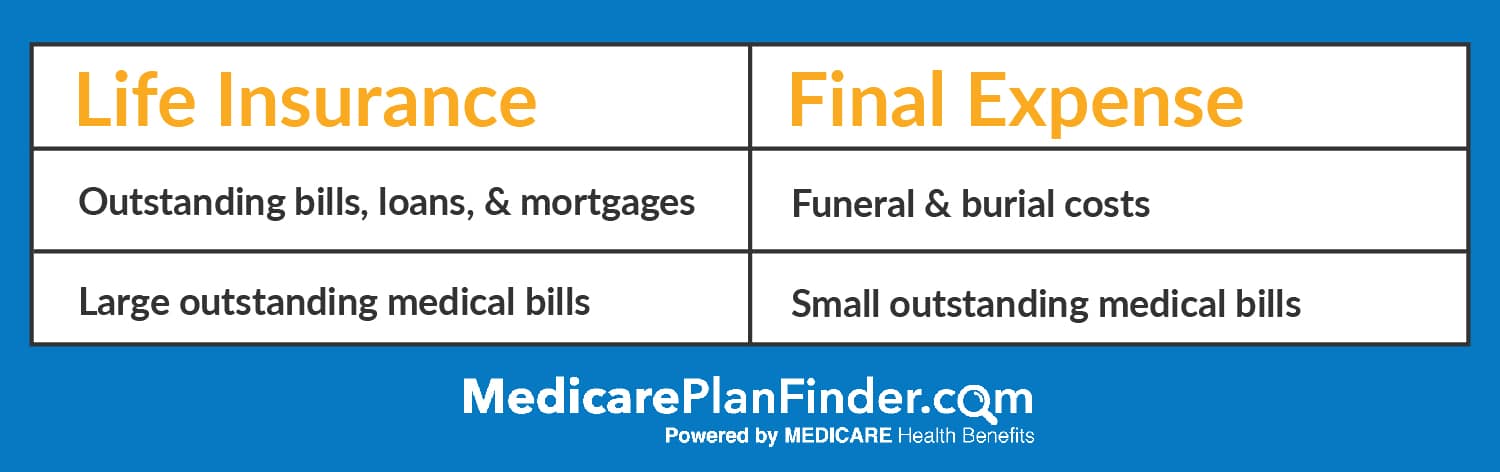

You may not need this kind of life insurance (average cost of burial insurance). If you have permanent life insurance policy in area your last expenses may currently be covered. And, if you have a term life policy, you might be able to convert it to a long-term plan without a few of the added actions of getting last cost protection

Expense Plan

Created to cover restricted insurance policy requirements, this sort of insurance coverage can be a cost effective option for individuals who merely intend to cover funeral prices. Some plans might have restrictions, so it is very important to read the small print to make sure the policy fits your requirement. Yes, naturally. If you're trying to find an irreversible alternative, universal life (UL) insurance coverage remains in position for your entire life, as long as you pay your costs.

This option to final cost insurance coverage gives options for added family insurance coverage when you require it and a smaller coverage amount when you're older. cheap funeral insurance.

5 Crucial realities to maintain in mind Planning for end of life is never pleasant. Neither is the idea of leaving liked ones with unanticipated expenditures or debts after you're gone. In most cases, these economic commitments can stand up the settling of your estate. Consider these 5 truths about final costs and exactly how life insurance policy can help spend for them - end of life insurance coverage.

Latest Posts

Buy Burial Insurance

Burial Insurance Cost For Seniors

List Of Final Expense Insurance Companies